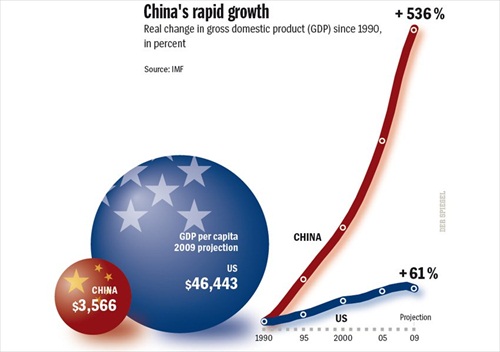

China overtook Germany to become the world’s third largest economy in 2007 and three years later reached another milestone by overtaking Japan as the second largest economy in the world. Since then China was predicted to overtake the US as the world’s largest economy powerhouse around 2025 or 2030 the latest. Judging from how the China’s economy is growing there’s no doubt that it’s a matter of time before the country would achieve such an awesome milestone.

But if the latest data posted on World Economy Outlook by International Monetary Fund (IMF) is reliable, the date of China becoming the new economic leader could be sooner than that – 2016. According to the figures, the Chinese economy would grow from $11.2 trillion in 2011 to $19 trillion in 2016. Over the same period, the U.S. economy will rise but at a slower pace from a dominant $15.2 trillion (2011) to a mere $18.8 trillion (2016). Hence China is set to be officially announced as the world’s dominant economic power starting the year 2016.

There would surely be continuous debates when that year arrives, if indeed the above prediction is correct. Analysts may argue that economic power should be measured by purchasing power parity (PPP) which means what your money can buy on the street. It should be measured by converting the national currency (in this case Chinese yuan or renminbi) into the U.S. dollar and measuring how much is flowing through the economy, the same way “Big Mac” index was used.

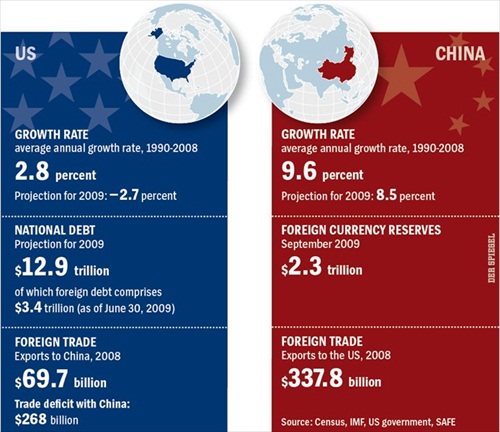

Interestingly IMF also projects U.S. GDP (in dollars, of course) will be $15.2 trillion in 2011 rising to $18.8 trillion in 2016; while China’s will be $6.5 trillion this year and almost doubled to $11.2 trillion by 2016. Under such yardstick U.S. will still be the largest economic powerhouse by 2016 (*phew*). In addition, if analysts were to measure per capita income as a proportion of GDP, the U.S. will still leads ahead of China. Even at IMF’s preferable measurement of GDP market rates, U.S., which is 130% bigger than China now will still be 70% larger by 2016.

IMF considers that GDP in purchase-power-parity (PPP) terms is not the most appropriate measure for comparing the relative size of countries to the global economy simply because PPP price levels are influenced by non-traded services, which are more relevant domestically than globally. But analysts argue that PPP is the closest you can get because it measures the output of economies in terms of real goods and services.

China has been the fastest growing economy in the world for almost three decades and in the process consumes more than a third of the world’s aluminum output, a quarter of its copper production, a tenth of its oil and accounts for more than half of the trading in iron ore. On another note, China is also the largest producer of food and agricultural products, seafood, cotton commodities, pork, textile and electronic products.

Nevertheless one has to remember that China still has a secret weapon – the deeply undervalued renminbi. Revalue the renminbi could shift the GDP figures drastically. Still, beyond 2012 the next U.S. President may not be so gentle with China, if President Obama were to lose the election to some crazy guys such as Donald Trump. Speculated to challenge Obama, Trump blasted Obama’s China policy in allowing China to succeed and prosper because apparently China is going to destroy America in the process.

What was in silly Donald Trump’s mind? Does he plans to invade China if the country continues to grow and overtakes U.S. while maintaining an artificial undervalue renminbi? Trump should be made to realize that China still has an estimated US$3 trillion in U.S. treasuries which it could dump it in the open market to create financial chaos. Can the U.S. outgrow the Chinese instead by cutting corporate tax from the top 35% to 25% or even lower?

Sure, the U.S. had confronted more-hostile enemies before namely the Nazi Germany and the Soviet Union but it had never had to contend with a rival that matched it in economic strength. Maybe a China economic bubble burst would do U.S. a favor by pulling the Chinese further away from matching the U.S. Maybe the Chinese would be happy to just suppress its currency further so that the U.S. can maintain it’s number one position (and to make U.S. happy in the process).

source : financetwitter

0 comments:

Post a Comment